How the dollar to PKR rate affects raw material rates in Pakistan

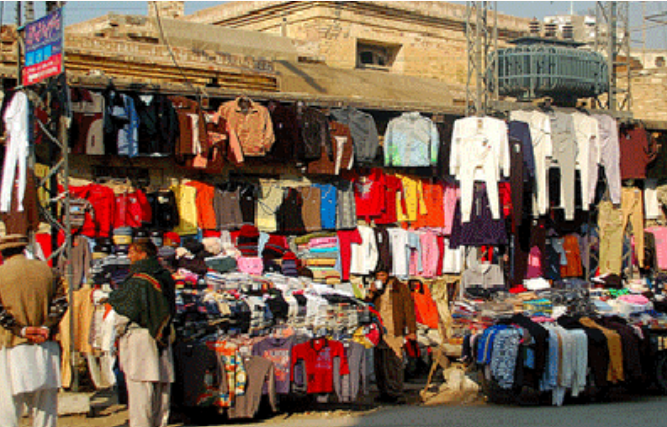

The dollar-to-PKR exchange rate plays a pivotal role in influencing the market rate fluctuations of raw materials in Pakistan. As the Pakistani Rupee weakens against the dollar, the cost of importing raw materials denominated in dollars rises. This increase in import costs directly impacts industries reliant on imported raw materials, such as manufacturing and construction. Consequently, businesses may raise prices to maintain profit margins, leading to inflationary pressures in the economy.

Conversely, when the dollar strengthens against the PKR, the cost of importing raw materials decreases. This can provide relief to businesses, potentially leading to lower production costs and, in turn, reduced prices for goods and services. However, a significantly strong dollar can also pose challenges for exporters, as their goods become relatively more expensive in foreign markets, potentially affecting demand and overall economic growth.

Furthermore, fluctuations in the dollar to PKR rate can also impact investor sentiment and confidence in the Pakistani market. A depreciating rupee may deter foreign investors due to concerns over currency risks and potential losses. Conversely, a strengthening rupee may attract foreign investment as it signals stability and potential returns. This influx or outflow of foreign investment can further influence market dynamics, including the demand for raw materials and their prices.

Overall, the dollar to PKR exchange rate serves as a crucial indicator for businesses and investors in Pakistan, directly impacting the cost of raw materials, inflation rates, export competitiveness, and overall economic stability. Monitoring and managing exchange rate fluctuations are essential for policymakers and market participants to mitigate adverse effects and foster sustainable economic growth.

To get the best daily rates for plastic dana, yarn and iron steel coils download the Zaraye app or contact us now!

.png)