In a groundbreaking move to revive Pakistan's textile sector, the government has unveiled a comprehensive Textile Policy for the years 2020-2025. This strategic roadmap aims to address past shortcomings, bolster the entire textiles and apparel supply chain, and position the nation as a competitive force in the global market.

Strategic Objectives

The policy outlines seven key strategic objectives:

- To encourage value addition at every stage of the supply chain, particularly in finished products.

- To restore the profitability of Cotton farmers through increased yield, improved quality, and decreased production costs.

- To strengthen the Man-Made Fiber (MMF) sector, making it export-oriented.

- To support textiles and apparel value-chain, not just for Business Management and Research (BMR) but also for new capacities.

- To facilitate manufacturing through temporary importation schemes and regulatory organization roles.

- To provide a level playing field, enhancing export competitiveness and increasing the sector's share in the domestic market.

- To prioritize Small and Medium Enterprises (SMEs) for infrastructure, compliance, energy efficiency, quality assurance, productivity, and e-commerce-related projects.

For Seamless Sourcing of Raw Materials - Request a Quote

Financial Commitments and Exchange Rate Dynamics

The government's commitment to settling pending liabilities and adopting a market-driven exchange rate set the stage for increased exports and reduced imports. The National Tariff Policy, now under the Ministry of Commerce, is poised to rationalize the tariff structure, providing an additional boost to the textiles and apparel value chain.

Incentive Schemes and Financing

The policy introduces various incentive schemes and financing measures:

- Temporary importation schemes for re-exports to diversify product base.

- Revision of customs duty drawback rates.

- Supply of energy to export-oriented units at regionally competitive rates.

- Duty drawback scheme (DLTL/DDT) for value-added textile products.

- Continued Long Term Financing Facility (LTFF) and Export Financing Scheme (EFS) rates.

- Review of LTFF and refinance scheme for SMEs and indirect exporters.

- Launch of a brand development and acquisition fund.

Taxation System

The taxation framework for the textile sector includes:

- Income Tax under the Normal Tax Regime (NTR).

- Minimum Tax at 1.5% of turnover, with flexibility for adjustment against future tax liabilities.

- 17% sales tax applicable across the textile value chain.

- Additional taxes on imports and exports.

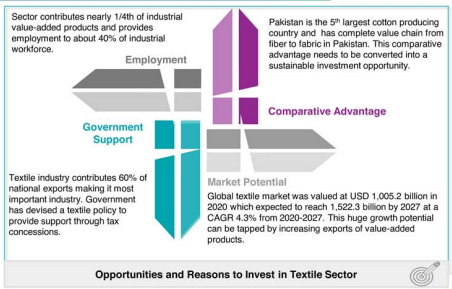

Government Initiatives and Support

The government is implementing several initiatives to support the textile industry:

- Launch of the vocational training program through the Public Sector Development Program.

- Establishment of the Pak Korea Garment Technology Institute in Karachi.

- Subsidies for export-oriented sectors, especially textiles.

- Subsidized power and gas tariffs for industry sustainability.

Duty Drawback Scheme and Financial Support

The Duty Drawback Scheme includes the Drawback of Local Taxes and Levies (DLTL) at 2% on eligible product lines. The government has allocated Rs 7.5 billion to support the industry under the Duty Drawback Scheme of the Textile and Non-Textile Sector.

SBP Scheme for Exporters

The State Bank of Pakistan (SBP) introduced a rupee-based discounting scheme for export bills. This scheme offers flexibility in understanding export proceeds and provides favourable refinancing rates.

Pakistan's Textile Policy 2020-2025 is a comprehensive strategy to transform the textile sector. By addressing key challenges, providing financial support, and aligning with global market trends, the policy sets the stage for a vibrant, competitive, and sustainable textile industry in the years to come. As the government fosters collaboration with international players, such as the recent engagement with Amazon makes the industry poised for significant growth and global recognition.

.png)